Retirement is a stage in life that most of us look forward to, but it also comes with significant financial challenges. While retirement offers freedom and relaxation, the reality of not having a steady income requires careful preparation. A well-thought-out retirement plan not only secures your future but also ensures you can maintain your lifestyle post-retirement. In this article, we will explore how smart investments can help secure your financial future and provide you with the peace of mind that comes with knowing you’re financially ready for retirement.

Why Retirement Planning is Crucial

The Need for Retirement Planning

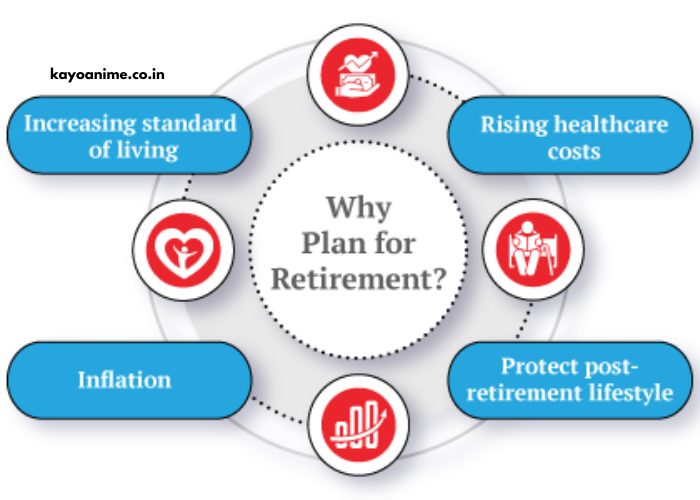

As life expectancy increases, it becomes essential to plan for a longer retirement period. Gone are the days when individuals could rely solely on pension plans or social security to fund their retirement years. With rising healthcare costs and inflation, relying on government-provided retirement benefits is often not enough. To maintain your quality of life, it is vital to establish a comprehensive retirement strategy and take proactive steps towards building your wealth over time.

Benefits of Early Retirement Planning

The earlier you start planning for retirement, the more time your investments have to grow. By taking a long-term approach, you give yourself the best chance of accumulating sufficient funds. Starting early allows you to take advantage of compound interest, which is the process of earning interest on both the principal and the accumulated interest. Over time, even small contributions can grow into a substantial nest egg.

Understanding Smart Investments for Retirement

Investing for retirement is not a one-size-fits-all approach. It requires evaluating your financial goals, risk tolerance, and the time horizon before you retire. There are numerous investment options available, and choosing the right ones can make a significant difference in the amount of wealth you accumulate over the years. Below, we discuss several smart investment strategies to consider when planning for your retirement.

1. Diversified Portfolio: Spreading the Risk

One of the key principles of retirement planning is diversification. A diversified portfolio includes a mix of different asset classes such as stocks, bonds, real estate, and cash. This strategy reduces the risk of putting all your eggs in one basket, as different asset classes perform well at different times. By spreading your investments across a variety of sectors, industries, and asset classes, you can protect yourself from the volatility of the stock market and economic downturns.

How to Build a Diversified Portfolio

A well-diversified portfolio typically consists of:

- Stocks: Equities or stocks tend to provide higher returns over the long term, though they can be volatile in the short term.

- Bonds: Fixed-income securities like government or corporate bonds are generally lower risk compared to stocks, offering steady returns.

- Real Estate: Real estate investments, such as rental properties or REITs (Real Estate Investment Trusts), can provide a source of passive income.

- Cash or Money Market Accounts: A small percentage of your portfolio should be kept in cash or liquid assets to maintain flexibility and access to funds.

By holding a combination of assets, you reduce your overall investment risk and increase your potential for long-term growth.

2. Stock Market Investments: The Power of Equities

Investing in the stock market is one of the most popular methods for growing wealth, especially over the long term. Historically, stocks have provided higher returns than other types of investments, such as bonds or savings accounts. Although the stock market can experience periods of volatility, the overall trend has been upward over the years.

Tips for Stock Market Investments

- Focus on Index Funds: Index funds track the performance of major market indices, such as the S&P 500. They offer broad market exposure and typically have lower fees compared to actively managed funds.

- Dividend Stocks: Consider investing in dividend-paying stocks, as they provide a steady stream of income in addition to potential capital gains.

- Long-Term Outlook: If you are investing for retirement, a long-term approach is ideal. Resist the urge to react to short-term market fluctuations, as this could disrupt your long-term investment strategy.

3. Bonds: Stability for Your Portfolio

While stocks offer higher returns, they also come with higher risk. Bonds, on the other hand, offer stability and are considered safer investments. Bonds provide fixed income over time and can help cushion your portfolio during market downturns.

How Bonds Work

Bonds are essentially loans made to corporations or governments, and in return, investors receive regular interest payments until the bond matures. At maturity, the principal amount is returned to the investor. Some common types of bonds include:

- Government Bonds: Issued by national governments, these are considered low-risk investments.

- Municipal Bonds: Issued by local governments, these bonds often offer tax advantages.

- Corporate Bonds: Issued by companies, these tend to offer higher interest rates but also carry more risk.

Including bonds in your retirement portfolio can help create a balanced and diversified investment strategy, providing income and lowering the overall volatility of your portfolio.

4. Real Estate: Tangible Assets for Retirement Income

Real estate investments can be a reliable source of passive income during retirement. Real estate properties, such as rental homes or commercial buildings, generate rental income, which can supplement your other retirement savings. Additionally, real estate can appreciate over time, further contributing to wealth accumulation.

Real Estate Investment Trusts (REITs)

If you prefer not to directly own physical property, REITs are an attractive alternative. These investment vehicles allow you to invest in a portfolio of real estate assets without the hassle of managing property yourself. REITs offer a way to earn income through real estate while maintaining liquidity, as shares can be bought and sold on the stock market.

5. Individual Retirement Accounts (IRAs)

IRAs are a key tool in retirement planning, providing individuals with tax advantages to encourage saving. There are two main types of IRAs: traditional and Roth.

Traditional IRA

Contributions to a traditional IRA are tax-deductible in the year they are made, meaning you reduce your taxable income for that year. However, when you withdraw funds in retirement, they are taxed as regular income. Traditional IRAs are ideal if you expect to be in a lower tax bracket during retirement.

Roth IRA

Roth IRAs work the opposite way. Contributions are made with after-tax dollars, meaning you don’t receive a tax break upfront. However, when you withdraw the funds in retirement, the withdrawals are tax-free. Roth IRAs are beneficial if you expect your tax rate to increase in the future or if you prefer tax-free withdrawals during retirement.

Retirement Investment Strategies Based on Age

The key to a successful retirement plan lies in how you allocate your assets based on your age and proximity to retirement. Below are some general investment strategies based on life stages.

In Your 20s and 30s: Early Years of Wealth Building

In your younger years, your primary goal is to build wealth. You have time on your side, which means you can take more investment risk in the pursuit of higher returns. During this stage, consider focusing on:

- High-growth stocks: Invest in stocks with strong growth potential.

- Maximizing Contributions to Retirement Accounts: Take advantage of employer-sponsored retirement plans and IRAs.

- Low-cost Index Funds: These funds provide diversification and are an excellent way to minimize risk.

In Your 40s and 50s: Transitioning Toward Preservation

As you approach your 50s, your focus should shift from wealth accumulation to preserving the wealth you have built. At this point, you may start to reduce your exposure to riskier assets like stocks and increase your allocation to bonds or other more conservative investments.

- Increase Bond Allocations: Bonds can provide stability as you get closer to retirement.

- Consider Annuities: Fixed annuities can offer a guaranteed income stream in retirement.

- Review Your Asset Allocation: Ensure your portfolio is balanced and aligned with your retirement goals.

In Your 60s: Preparing for Retirement

In your 60s, it’s time to finalize your retirement plan and ensure your investments will provide enough income for your retirement years.

- Preserve Capital: Focus on low-risk investments that provide steady income, such as bonds and dividend-paying stocks.

- Plan for Healthcare Costs: Healthcare expenses tend to rise with age, so plan accordingly.

- Consider Downsizing: If you own a home, consider downsizing to free up cash for retirement.

Conclusion: Start Planning Today for a Secure Future

Retirement planning is an ongoing process that requires careful thought and strategic action. The earlier you start, the more time you give yourself to build wealth through smart investments. By diversifying your portfolio, investing in stocks, bonds, real estate, and IRAs, and adjusting your investment strategy as you approach retirement, you can ensure a secure financial future.

Remember, retirement is not just about accumulating wealth but also about planning for a life that allows you to enjoy your later years without financial worry. Start today, and use smart investments to secure your future.